We recognize that some of our students have not had previous experience writing personal checks. This page provides information how to write a check as well as some check writing tips.

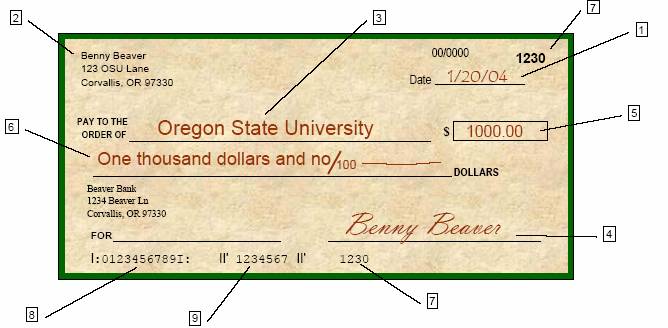

1.) Date - the date the check is written (cannot be a future date)

2.) Maker - person/business who writes the check - the name will be printed on the check

3.) Payee - person/business to whom the check is written

4.) Signature line or lines - two or more signatures can be required on a check

5.) Written amount - the amount written in numbers

6.) Legal amount - the amount written in words

7.) Check number - which is printed on the check and appears in the MICR line on the bottom of the check

8.) Routing number - appears in the MICR line on the bottom of the check

9.) Account number - appears in the MICR line on the bottom of the check

When you write a check, make sure all information is clearly written in a form that cannot be altered.

Put all check information as far to the left on each line as possible.

When filling in the written amount, draw a line through any remaining space.

Print the written amount of the check; don't write it longhand.

Never use abbreviations when you fill in the payee information on the "Pay to the order of" line.

Always use a pen when filling out a check, never a pencil or felt-tip marker.

Your signature should match the one on file at your bank. Never scribble illegibly - illegible scrawls are easy to forge.

Use the current date on a check; never postdate it. To avoid alteration, write out the date instead of using numerical abbreviations.

Make sure that the written amount is exactly the same as the numerical amount. If the two differ, the written amount is considered legally binding. For clarity, use the word "and" only once, between the dollar and cents figures. Example: One Hundred Twenty Nine and 39/100; not One Hundred and Twenty Nine and 39/100.

To prevent overdrawing your account, immediately record the check in your checkbook register - include the amount, the date, and the person to whom the check was made out (the payee).