* This information replaces FIS 410-32 Participant Support Costs

Participant support costs are those costs made to (or on behalf of) an individual who is engaged in training and/or research in a specific field or program. Generally, these costs are funded by grants and/or contracts.

Participants may include students, visiting scholars, scientists, workshop attendees, or teachers (K-12). OSU employees cannot be paid as participants.

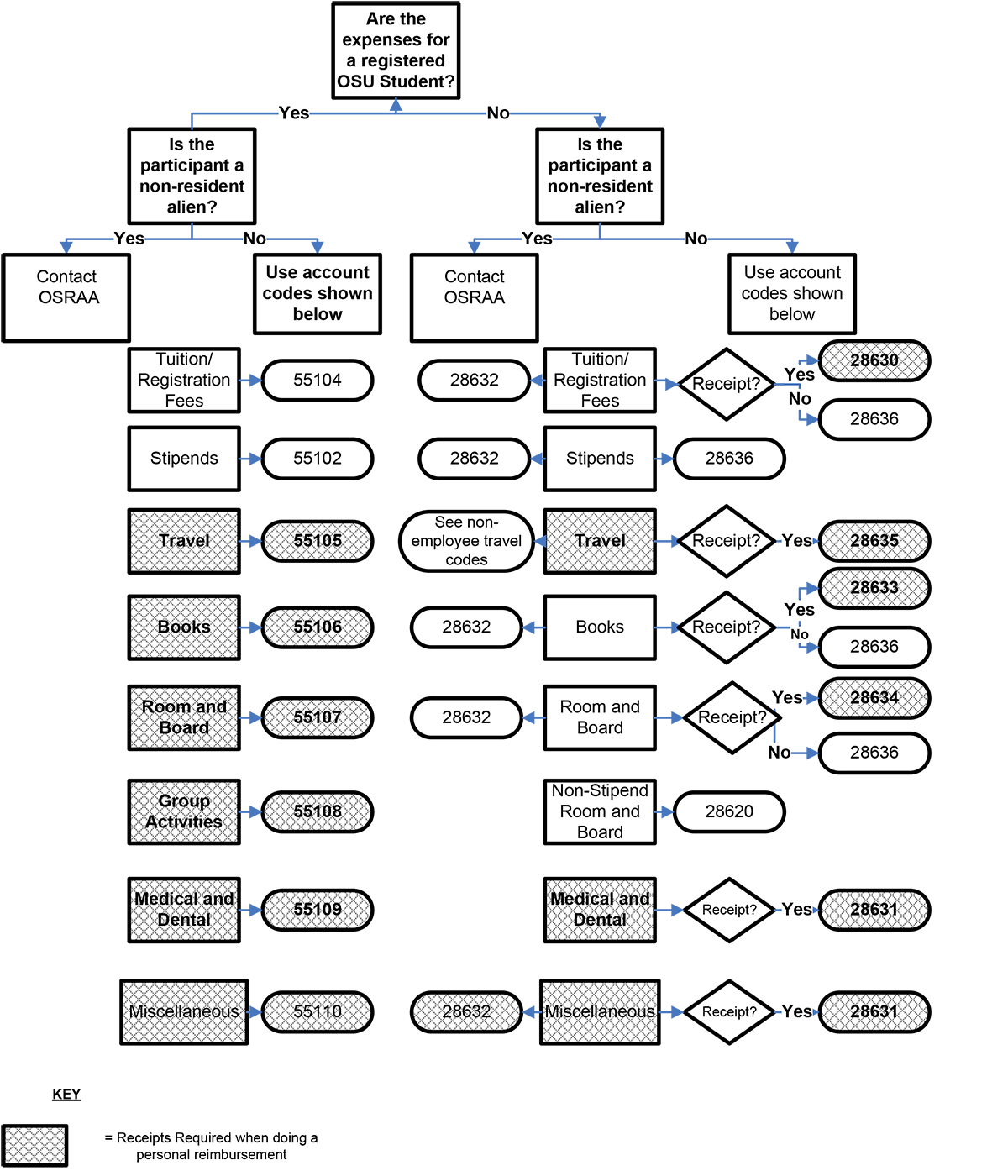

The 551XX series of account codes are designated for paying or reimbursing OSU registered students, including research fellows. The 28620 and 2863X account codes are for payment of expenditures related to individuals who are not OSU registered students (including post-docs).

Non-resident alien participants must be identified so their associated costs are recorded correctly for 1042S IRS reporting. All costs must be processed by Office of Sponsored Research and Award Administration (OSRAA).

A stipend payment is a predetermined amount allocated to the participant regardless of actual incurred expenses. The stipend amount is usually specified in the sponsored agreement. Stipends are not to be confused with per diem. Stipend payments are posted as follows:

- 55102 stipend for OSU registered students

- 28636 stipend for non-OSU participant (1099 reportable)

- 28632 stipend for non-OSU participant, non-resident alien (1042S reportable)

Participant support payments for OSU and non-OSU registered students are coordinated with OSRAA. Tuition and fee payments, account code 55104, can only be applied to the student’s account by OSRAA.

The following non-OSU participant support payments must be documented by receipts:

- 28630 tuition and registration fees

- 28633 book allowance

- 28634 room and board

- 28635 travel

- 28631 other (miscellaneous)

Expenses connected with a conference: room rental, meals, refreshments, travel, and/or equipment rental should not be paid using the 2863x account codes. Conference expense account codes (28602-28606) should be used for organized conferences and workshops sponsored by OSU when there are persons from outside OSU in attendance.

Expenses connected with hosting a group of participants: refreshments or meals should not be paid using the 2863x account codes. Account code 28612 Hosting Groups and Guests is appropriate for expenditures of refreshments or meals provided to participants which are not included in a room and board package or are not part of an organized conference/workshop.

When supplies are purchased in connection with participants and the supplies do not remain with the participants, the expense should be coded 20102 General Operating Supplies.

Examples of costs which should not be recorded as 2863x participant support:

|

Expense |

Location |

Example of Participant(s) |

Account Code |

|---|---|---|---|

|

Room rental fee for workshop |

OSU |

K-12 teachers |

28606 |

|

Refreshments/meals for workshop or conference (OSU sponsored) |

OSU |

Visiting scholars or scientists |

28604 |

|

Refreshments/meals for workshop or conference (non-OSU sponsored) |

Community College |

Workshop attendees |

28612 |

|

Refreshments for math/science club |

Oregon high or elementary school |

K-12 students/teachers |

28612 |

|

Homestay Stipend to host non-resident alien |

Private community home |

Community member |

28620 |

|

Air travel |

From international location to Corvallis |

Visiting professor |

39645 |

|

Meals outside of workshop or conference |

OSU |

Conference or workshop attendees |

28612 |

For assistance in determining the correct account code, please review the flowchart, examples shown above, and the account code definitions within FIS Ex003-02 Account Codes.

Participant Support Flowchart or Decision Tree